Nys Estimated Tax Payments 2025 Online

Nys Estimated Tax Payments 2025 Online. Estimate your new york income tax burden. Scroll up to the 20xx estimated tax payments section.

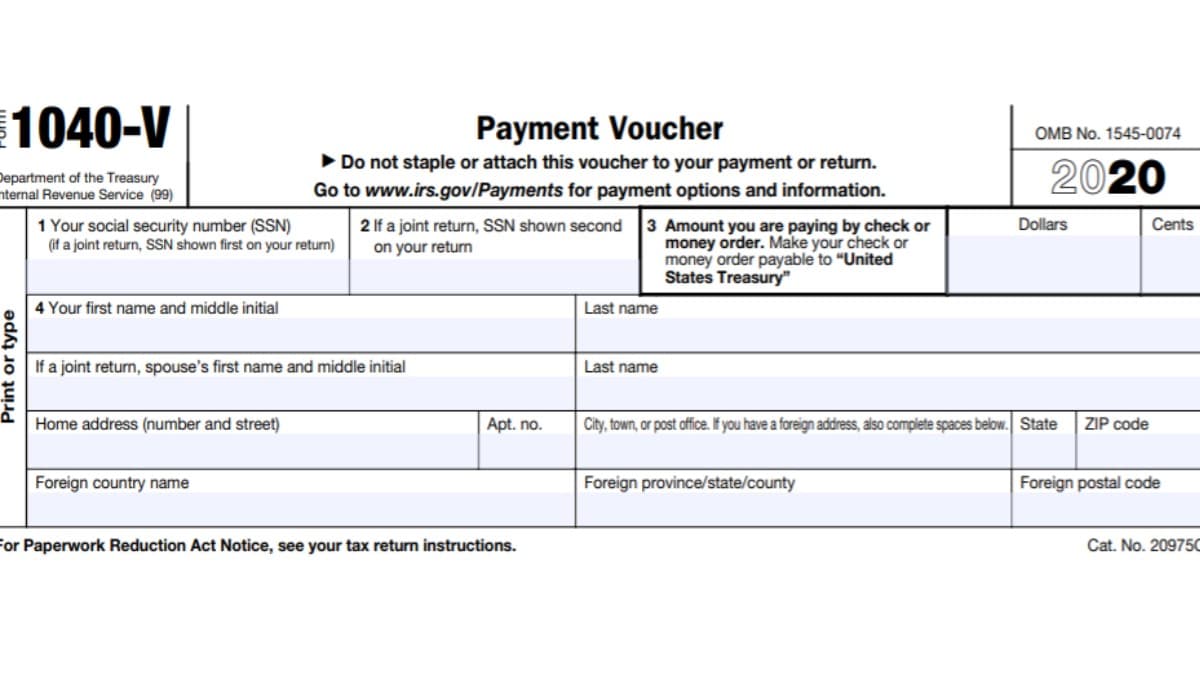

Federal Estimated Tax Payments 2025 Form Bibi Marita, You can meet this requirement. Go to screen 6, 20xx estimated tax payments.

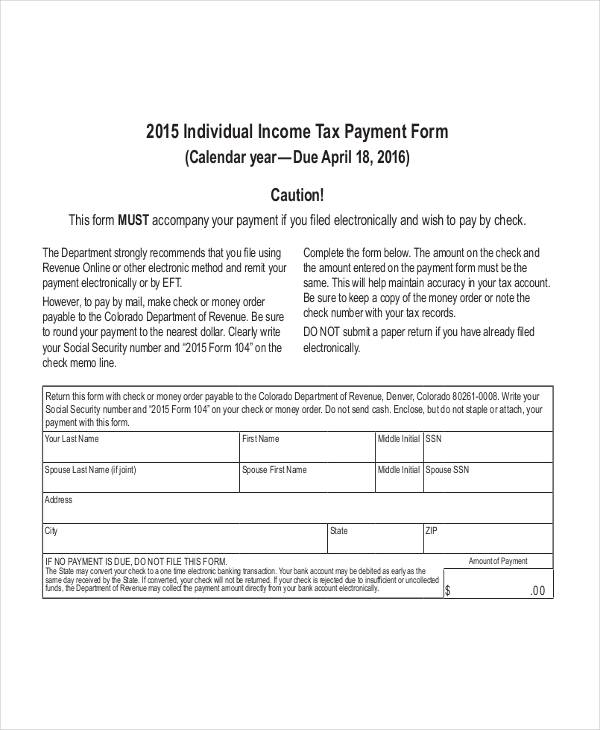

2025 Tax Calendar Mark Your Dates! Filing Season and Key Deadlines, For instructions on how to compute estimated income tax, see the worksheet provided on the dr 0104ep. How to make an estimated payment.

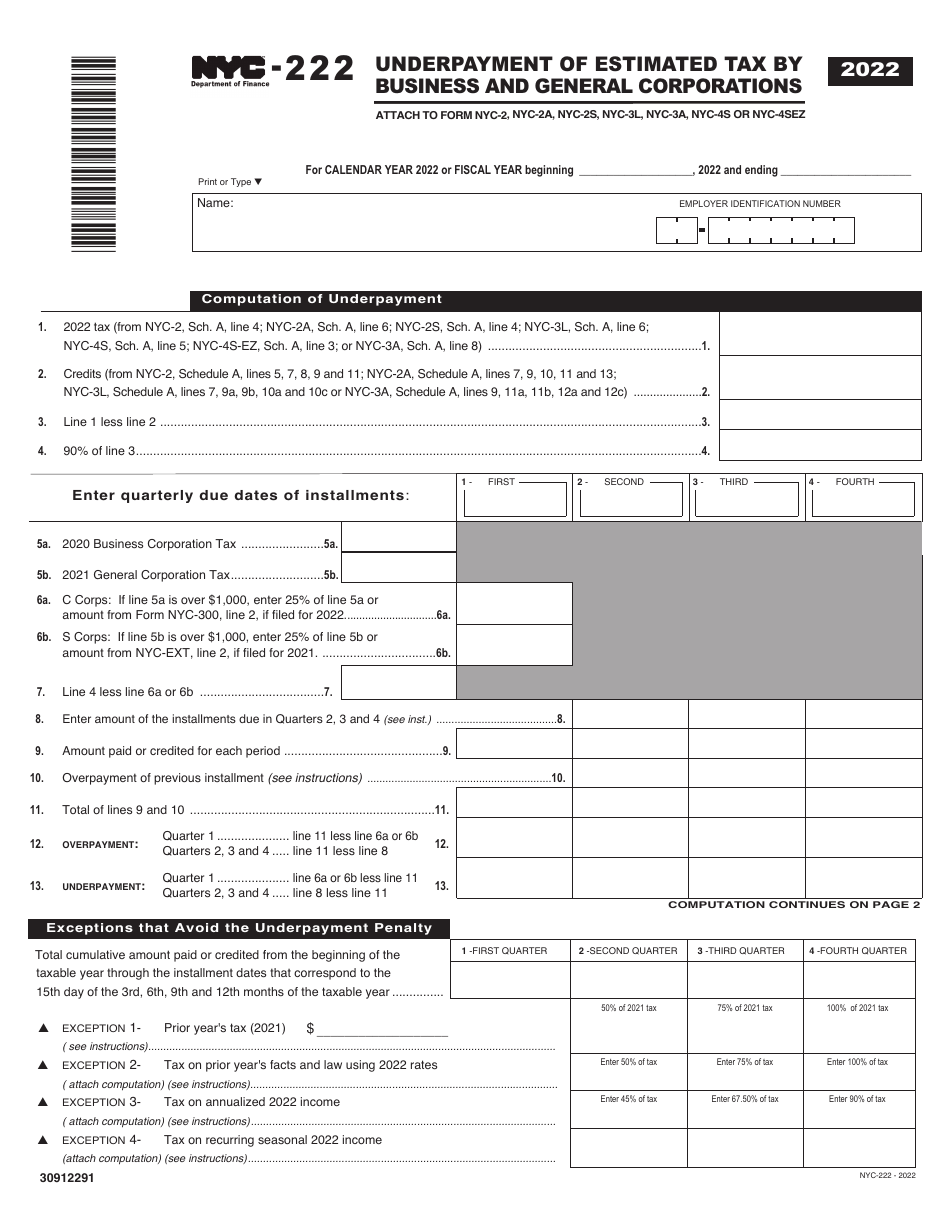

Form NYC222 Download Printable PDF or Fill Online Underpayment of, The new york tax estimator lets you calculate your state taxes for the tax year. 16, with the final payment being due january 2025.

How to pay estimated quarterly taxes to the IRS YouTube, Estimate your new york income tax burden. This saves you from having to submit payments yourself.

How to calculate estimated taxes 1040ES Explained! {Calculator, If you make $70,000 a year living in new york you will be taxed $11,074. Paying estimated tax helps your clients avoid owing money at the end of the year when they file their tax returns and avoid accruing interest and penalty.

Federal Estimated Tax Payments 2025 Fran Paloma, To make additional payments for 2025. Updated on apr 24 2025.

Nys Tax Refund Schedule 2025 Eddy Nerita, The remaining due dates are june 17 and sept. Pay using an online services.

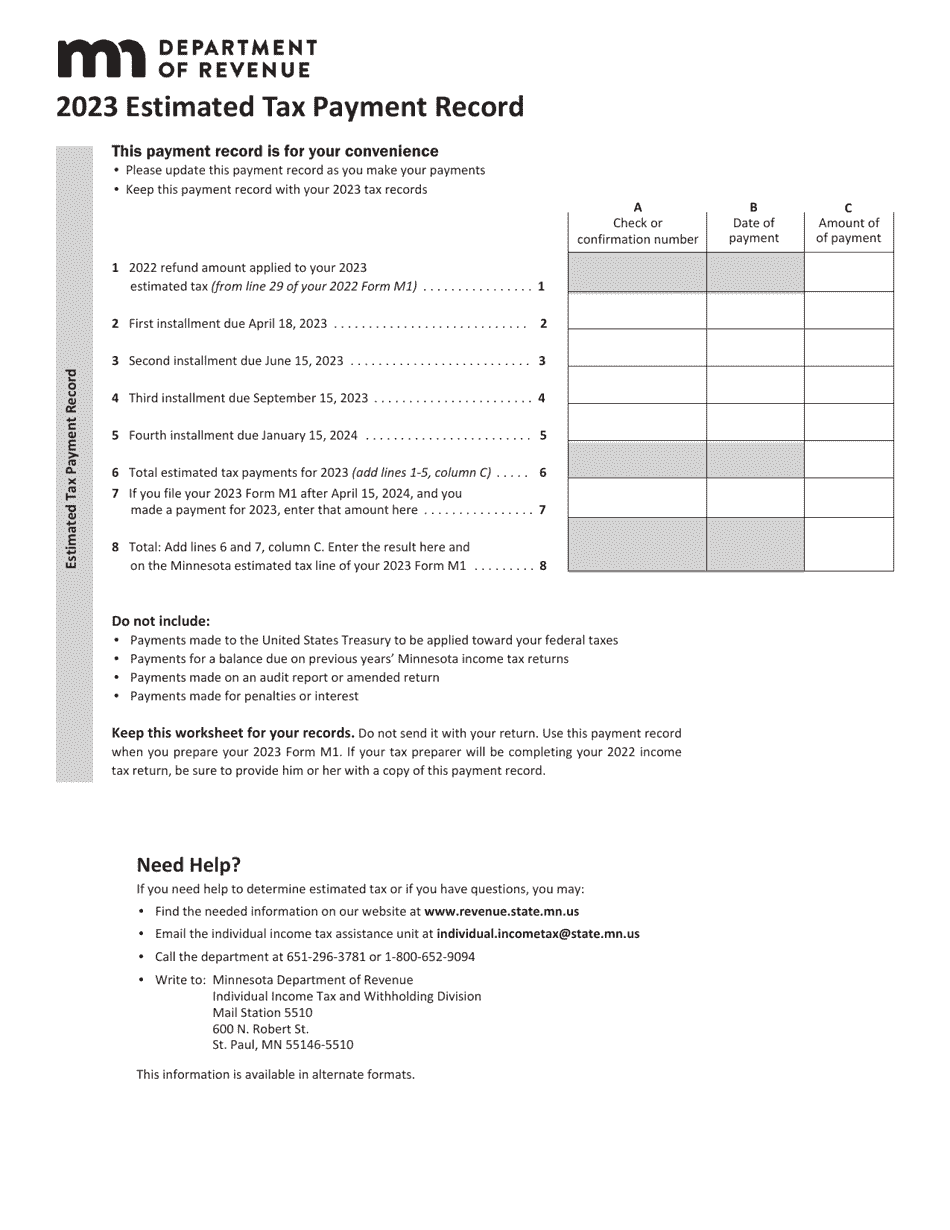

2025 Minnesota Estimated Tax Payment Record Fill Out, Sign Online and, To make additional payments for 2025. Sometimes, you can deviate from the set estimated tax payments schedule by following specific rules.

New York State Itemized Deductions 2025 Pia Leeann, You will need to create an irs online account before using this option. Estimate your new york income tax burden.

Federal 2025 Estimated Tax Forms Damita Coletta, Select payments, bills and notices,. For example, if you pay all your estimated taxes for 2025.

Paying estimated tax helps your clients avoid owing money at the end of the year when they file their tax returns and avoid accruing interest and penalty.